The Cloudification of Telcos and the Evolution of the Telecom Ecosystem

Summary

In the rapidly evolving telecom sector, the concept of “cloudification” is not just a trend but a transformative shift, reshaping how services are delivered and managed. This change is underpinned by modern software architectures featuring modularity, microservices, and cloud-native designs. As we embrace this new era, marked by the rise of “netcos” and “servcos,” we must also navigate the complexities it brings.

Introduction

The telecom industry is currently undergoing a significant transformation, often referred to as “cloudification.” This change isn’t just a buzzword; it represents a fundamental shift in how telecom services are delivered and managed. Alongside this, there’s an intriguing development in the structure of the telecom ecosystem, particularly in the transition from traditional verticals to horizontal models, including the emergence of “netcos” (network companies) and “servcos” (service companies).

Modern software architecture: The backbone of cloudification

The cloudification of telecoms is deeply rooted in modern software architecture. Key characteristics of this architecture include:

-

Modularity: Breaking down software into smaller, interchangeable modules.

-

Scalability: Efficiently managing increasing workloads and user numbers.

-

Microservices architecture: Using independently deployable, loosely coupled services.

-

Cloud-native design: Exploiting cloud platforms’ advantages like distributed computing.

-

Continuous integration/deployment (CI/CD): Streamlining development and deployment.

-

API-first design: Prioritizing API development for better integration.

-

Security and compliance: Incorporating security measures from the ground up.

-

Resilience and fault tolerance: Maintaining functionality amidst failures.

-

User-centric design: Focusing on intuitive and responsive user experience.

-

Agility and flexibility: Adapting rapidly to changing business and technology needs.

This shift to this modern approach for the software systems that make up or support network functionality creates the foundation for the change we see now.

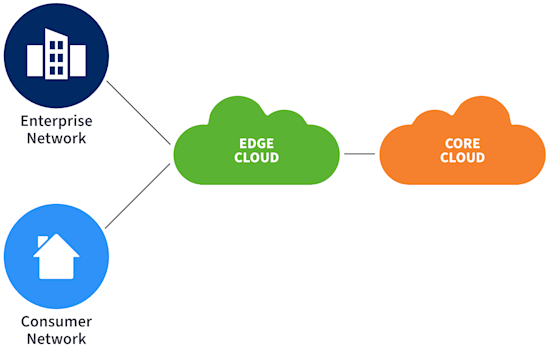

The shift of location of the network functionality

Cloudification in telecom also means moving some network functions from specialized hardware to generic server hardware. This transition enables software and functionalities to be deployed wherever it makes sense. However, it’s important to note that not all functions suit this shift. For example, big iron routers in global transit networks still consist of specialized hardware optimized for this particular function.

Functions that are being cloudified include mobile core systems, customer management, network management, SDN controllers, firewalls, analytics, monitoring, and, crucially, APIs. Conversely, functions like switching, forwarding, routing, and physical network components still rely on dedicated, on-prem hardware and probably will for some time to come. But also here, the systems are modularized, programmable, API-based, and scalable using modern software architecture.

The telco companies have different approaches – some build close partnerships with the hyperscalers and can use the same technologies – both in the public clouds and in private instances dedicated to the telcos, while others are building their own private clouds from the ground up.

Does this result in new needs? Yes, just like traditional networks are supported by several tools and systems, for example, a network monitoring system, the visibility the operators are used to is still needed even though the software is now running in a public cloud. We need to know about the health of the instances and how traffic flows in a system that now consists of dedicated and specialized hardware on-prem (or out in the field) and systems running in various versions on public and private cloud infrastructure.

The telco ecosystem: Netcos and servcos

An interesting aspect of this transformation is restructuring the telecom and internet industry from verticals to horizontals. This change manifests in the division of companies into servcos and netcos. Servcos focus on developing and selling services and owning end-user customers, while netcos own and operate the network infrastructure. This decoupling allows, in the ideal scenario, services developed by servcos to run on any network facilitated by netcos.

This division mirrors the modularity and microservices approach in software design, where separate components (or services) are developed independently but work together. It allows for specialization in each domain, leading to more efficient and scalable operations. The servcos can move fast and agile since they are no longer needed to care about operating legacy networks. With netcos moving to a pure wholesale model with only servcos as customers, they can simplify and optimize their operation. In some instances, the split goes beyond just a netco, but splits into a netco, fiberco, and towerco, which we see in the UK and Italy. Another aspect of the netcos operating model is to attract long-term investors to finance the physical infrastructure.

In the ultimate scenario, a servco competes on service innovations and provides their products running on several netcos, completely unknown or cared for by the end customers. Netcos, on the other hand, compete on efficiency and geographical scopes and might even be subject to price regulation in some markets.

The model isn’t entirely new. For example, BT’s Openreach was established in 2006 following a strategic review by Ofcom in 2005, which identified the need for a new organization to manage the UK’s phone and broadband network fairly, previously controlled by BT. This was to ensure equitable access for all communication providers. In 2017, as part of the Digital Communications Review by Ofcom, Openreach became a legally separate company, operating as a wholly owned subsidiary of BT plc. This separation aimed to improve the digital communications market for consumers and businesses.

We have even seen the introduction of a new layer, the API provider, that helps create the links between the customers, the services, and the network operator.

Reach is such a company. Reach is a global SaaS platform where customers can create wireless products. WideOpenWest (WOW) is using Reach to create a mobile offering to their internet access and cable customers. Reach acts as a middle layer between the servco WOW and the netco T-Mobile.

The National Content and Technology Cooperative that sets up tech deals for its members – 700+ cable and telco operators in the US – has entered an agreement with Reach so the members can use Reach to create mobile offerings for their end customers.

It’s a new paradise! Or is it?

This all sounds fantastic, but what are the downsides to this model?

Competition drives innovation up and prices down, and it is easy to imagine this happening in the servco layer. But it is just as easy to imagine consolidation and monopolies happening in the netco layer. So, what are the potential downsides and pitfalls ahead?

As mentioned, the risk of monopolization or at least limited competition between netcos creates a risk of high prices, long delivery times, and limited innovation in this layer.

Another risk is the increased complexity from end-user to production. With a number of different organizations and customer/provider relationships in the production chain, there will be an increased risk that when something goes wrong, it’s challenging to find out where and get it fixed quickly.

Other risks are vendor lock-in and missing interoperability.

Conclusion

In conclusion, the telecom industry is at a pivotal point, embracing cloudification and evolving into a more dynamic and flexible ecosystem. This transformation is not just a technological shift but a complete overhaul of traditional business models, leading to the emergence of “netcos” and “servcos.” Adapting modern software architecture principles, such as modularity and microservices, is pivotal in this evolution, allowing telecom companies to be more agile, efficient, and customer-centric. This trend will likely accelerate as we look to the future, driven by continuous technological advancements and changing consumer demands. It’s an exciting time for the industry, with significant opportunities for innovation and growth, not just for the companies involved but also for the consumers who stand to benefit from more diverse, efficient, and tailored telecom services.

The telco industry’s efforts to foster more agility with a modern approach brings inevitable complexity and distribution to its network and systems. The distributed nature of modern telcos and service providers leans towards monitoring and observability systems that can see it all – from an on-prem data center to the cloud to the internet and everything in between.

Read more:

Telecoms delayering is coming, the future is ServCo and NetCo